Harnessing Odds for Informed Decision-making

In this article, we embark on a journey to unravel

Betting Odds and Probability: Delving into the Intricacies of Mathematical Prediction

In this article, we embark on a journey to unravel the layers of mathematical prediction that shape betting outcomes.

In sports betting in Ghana, where chance and risk intertwine, an intricate web of mathematics governs every wager placed. Beyond the surface allure of luck and victory, a deeper understanding of betting odds and probability reveals the intricate mathematical tapestry that underpins the industry.

Decoding Betting Odds

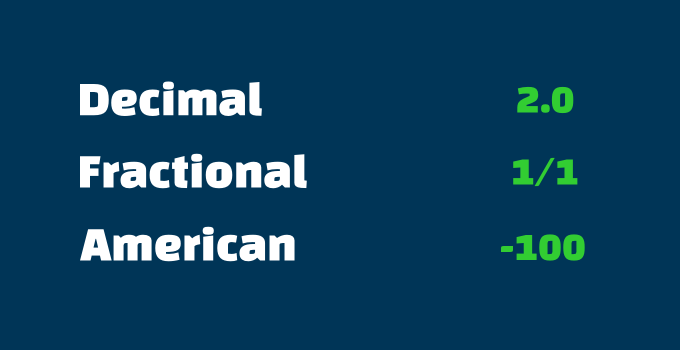

Betting odds manifest in formats variety, each with its distinct way of conveying the likelihood of an event's occurrence. These formats include fractional, decimal, and moneyline types.

Fractional odds, often referred to as British, present as a fraction. The numerator denotes the potential profit, while the denominator signifies the amount wagered. For instance, odds of 5/1 imply a potential profit of $5 for every $1 staked.

Decimal odds, commonly used in Europe, are expressed as decimals. The number represents the potential total payout, including the original wager. For instance, odds of 3.00 suggest a potential total payout of $3.00 for every $1 wagered, including the initial stake.

Moneyline odds, popular in the United States, convey the relationship between the wager and the payout. A positive moneyline (e.g., +150) signifies the potential profit for a $100 wager, while a negative moneyline (e.g., -200) indicates the amount one needs to wager to secure a $100 profit.

Odds and Probability

Fractional odds, characterized by their ratios, provide a unique perspective on the likelihood of an event occurring. The numerator represents potential profit, while the denominator signifies the stake. Calculating the implied probability from the fractional type requires dividing the denominator by the sum of the numerator and denominator. For instance, odds of 3/1 imply a 25% chance (1 / (3 + 1)) of success.

Decimal odds, prevalent in Europe, offer a straightforward translation to implied probability. The decimal number represents the potential payout, including the original stake. Calculating the implied probability from decimal odds involves dividing 1 by the decimal type. Odds of 4.00 reflect a 25% chance (1 / 4.00) of the event happening.

In the realm of moneyline, positive and negative values paint a picture of both potential profit and implied probability. For positive moneyline (e.g., +150), the formula is 100 / (moneyline + 100). For negative moneyline (e.g., -200), the calculation is -moneyline / (-moneyline - 100). If the resulting value is below 1, convert it to a percentage.

Illuminating Bookmakers' Margins

Delving deeper, the enigmatic concept of the ‘overround’ or ‘vig’ emerges—a cornerstone of bookmakers' operations. The overground constitutes the margin that bookmakers embed within their odds to ensure profitability irrespective of the outcome. This mathematical safeguard maintains a discrepancy between the implied probabilities of all potential outcomes and the sum of 100%, guaranteeing bookmakers a profit.

The margin of bookmakers' offices is their guaranteed earnings, a certain percentage that bookmakers charge from each bet made. The size of the margin directly affects the size of the offered odds: the lower it is, the more favorable the odds are for the betting enthusiast. The bookmaker does not hide what margin he lays, but the specific figures on the sites are not specified, and therefore to assess the effectiveness of the game in a particular office you need to learn how to calculate the margin yourself.

Margin is easy to understand when betting on equal probability outcomes. The probability of the eagle and tails falling out when tossing a perfectly symmetrical coin is 50%.

Translate the chance into odds using the formula:

100 / P, where P is the probability in percent.

Find the probability in percentages using the inverse formula:

100 / O, where O is the odds.

Without margin, the odds on the eagle or tails is 2.00: 100 / 50.

The bookmaker can give the odds on the eagle or tails, for example, 1.90. In this case, the probability of heads or tails is 52.63%: 100 / 1.90.

The sum of probabilities will be 105.26%: 52.63% + 52.63%. This extra 5.26% is the bookmaker's margin.

Strategic Insights

In the intricate realm of betting, where chance and strategy converge, odds serve as the compass that guides bettors through the labyrinthine landscape. Armed with the ability to interpret and analyze odds, bettors gain a strategic advantage that transcends mere speculation. This article delves into the insights that odds offer, empowering bettors to make informed decisions and navigate the betting world with precision.

- Implied Probability: By calculating the implied probability of each set of odds, bettors gain insight into how the market perceives the likelihood of success.

- Value Betting: When the calculated probability differs significantly from the implied probability of odds, a window of opportunity opens. This phenomenon, known as value betting, allows bettors to capitalize on odds that offer higher potential returns than the actual probability suggests.

- Comparative Analysis: Gamblers engage in comparative analysis, seeking inconsistencies in odds offered by various operators. These disparities can be indicative of differing market assessments or undervalued opportunities that can be leveraged for advantage.

- Understanding Line Movement: Odds are not static; they evolve as new information emerges and bets are placed. Line movement—changes in odds over time—offers valuable insights into market sentiment and potential trends. Punters keenly observe line movement to gauge the direction in which odds are shifting, enabling them to anticipate changes and make timely wagers.

- Bankroll Management: Betting extends beyond interpreting odds; it encompasses prudent bankroll management. Skilled bettors allocate their bankroll wisely, recognizing that each wager carries an element of risk. Strategic decision-making involves assessing potential returns against the calculated probability and aligning bets with personal risk tolerance.

- Embracing Long-Term Thinking: The toolbox of bettors includes the application of the Kelly Criterion—a mathematical formula that helps determine the optimal bet size. By considering the perceived edge, bankroll size, and odds, the Kelly Criterion guides bettors in maximizing growth while minimizing the risk of significant losses.

- Responsible Gambling Practices: Players understand the importance of maintaining discipline, setting limits, and avoiding impulsive decisions. The strategic lens encourages informed choices that prioritize long-term success over short-term gains.

The Art of Informed Speculation

Strategic insights, born from the mastery of odds interpretation, transform betting from a game of chance into a realm of informed speculation. Armed with knowledge, data, and a mindset, bettors navigate the complex web of odds with precision. As you embark on your journey, remember that odds are not just numbers—they are tools that unveil opportunities, illuminate trends, and empower you to make calculated decisions in the ever-shifting tides of chance.